Reverse Mortgage Loan Process

By: Review Counsel Staff

October 21, 2024 • 1 minute read

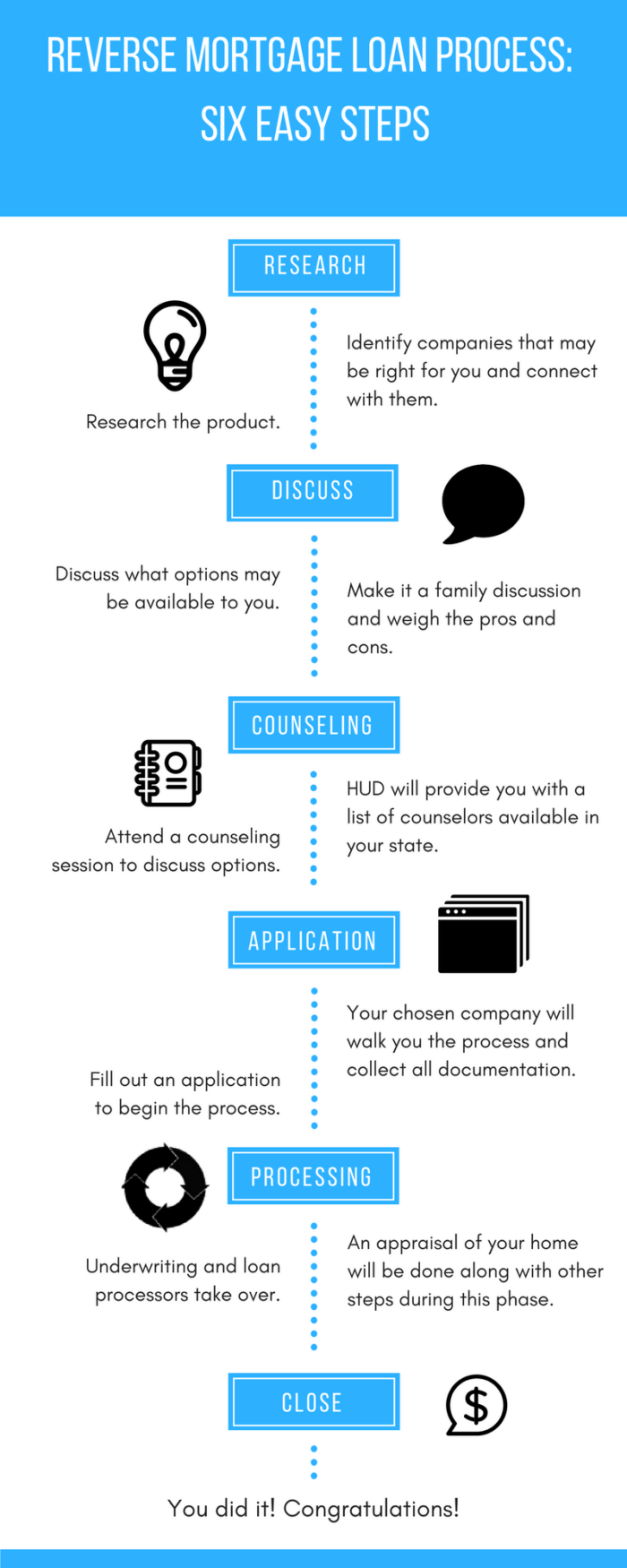

Getting a reverse mortgage is a relatively simple process. We break it down into six easy steps: Research, Discuss, Counseling, Application, Processing, and Close. The time required to get a reverse mortgage can be as fast as a few weeks and as long as several months depending on your unique situation. Speak with a licensed reverse mortgage loan officer in your state to learn more about the process as well as to ascertain how long their company’s process may take.

For more information on our Top 5 Reverse Mortgage lenders click here. We break down the top companies in the reverse mortgage space along with a consumer guide outlining pros and cons of a reverse mortgage and how a reverse mortgage works. We also present the best in class companies and our recommended choices for consumers.